[avatar user=”jhearn” size=”thumbnail” align=”left” /]

updated May 3, 2021

As the world economy continues to adjust to the economic forces brought on by the Global Pandemic, vaccine availability is bringing a wave of optimism. The first quarter of 2021 saw a surprising bounce back for the U.S. Economy and Americans are hopeful this momentum can continue.

In this Coronavirus focused edition of Wreckonomics© we’ll be looking at many of the same markers and parameters of past economic conversations as they relate to our current situation. There are so many unknowns about our economic futures and outcomes but we’ll do our best to provide an overview of current market situations and emerging forces to contend with.

Before we focus on the American Automotive markets and the sustained and specific demand on low value vehicles we’ll look take a look at some of the Macro Economic forces.

The World Economy

While much of the world continues to grapple with the devastating effects of COVID-19, there is some encouraging economic performance data. In previous Markets and Metals posts we’ve talked about China’s Coronavirus recovery and growth. Most of the supply chain interruptions from Chinese manufacturing have been restored and China’s delivery of lower priced and in-demand products has been significant in their recovery. While the U.S. is less production focused the current gains that we see in GDP and are related.

Employment

Prior to the Pandemic the U.S. unemployment rate was at a record low of 3.5%. In April of 2020 the Unemployment rate hit 14.7% (representing over 20 million jobs lost). These numbers have been steadily recovering with the March 2021 rate at 6%. However, these numbers fail to tell the full story as millions of workers remain on federally funded unemployment benefits and by many accounts seem reluctant to get back to work.

GDP

Gross Domestic Product remains an important indicator of economic health and the U.S. GDP increased at an annual rate of 6.4 percent in the first quarter of 2021 Far surpassing most estimates at the outset of the Pandemic.(bureau of economic analysis)

Stock Market

Likely the chief contribution or the current feeling of economic positivity is the performance of the Stock Market. Defying expectations and many explanations the Dow Jones Industrial Average reached record heights in April of 2021.

Consumer Confidence

The most ethereal of the indicators Consumer Confidence index soared in March. Fueled by vaccine optimism and skyrocketing housing prices. The only dark spot in the eyes of some economists is the looming possibility of inflation

While these leading economic indicators are a sign of general optimism, performance of the Automobile industry and transportation sectors is under a different microscope and faces specific challenges. We have talked earlier about product scarcity and demand in automotive and these forces are being felt more acutely now. Let’s take a look

U.S. Transportation and Mobility

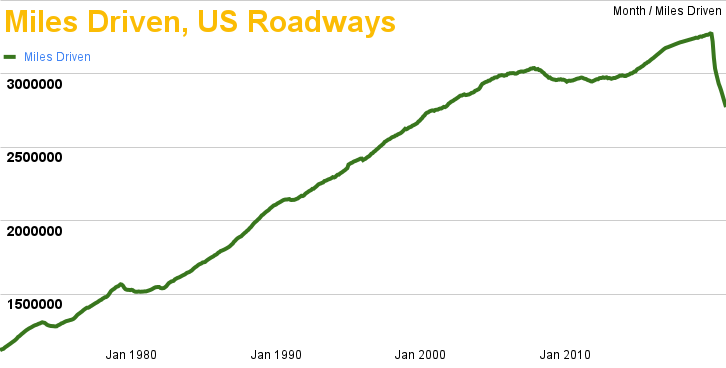

Miles Driven

Transportation was hugely transformed by the Global Pandemic. Worldwide shelter in place and travel bans forced travel way down. Work from home moved commuters out of the subway or HOV lane and on Zoom. In the U.S. we saw an abrupt and significant drop. Even as the restrictions have loosened, the drops have continued into 2021. The most recent data from March 2021 has not reversed the trend. As we move into months of lessening restrictions we hope to see this trend to sharply bounce back.

Source: Federal Reserve Economic Data (FRED)

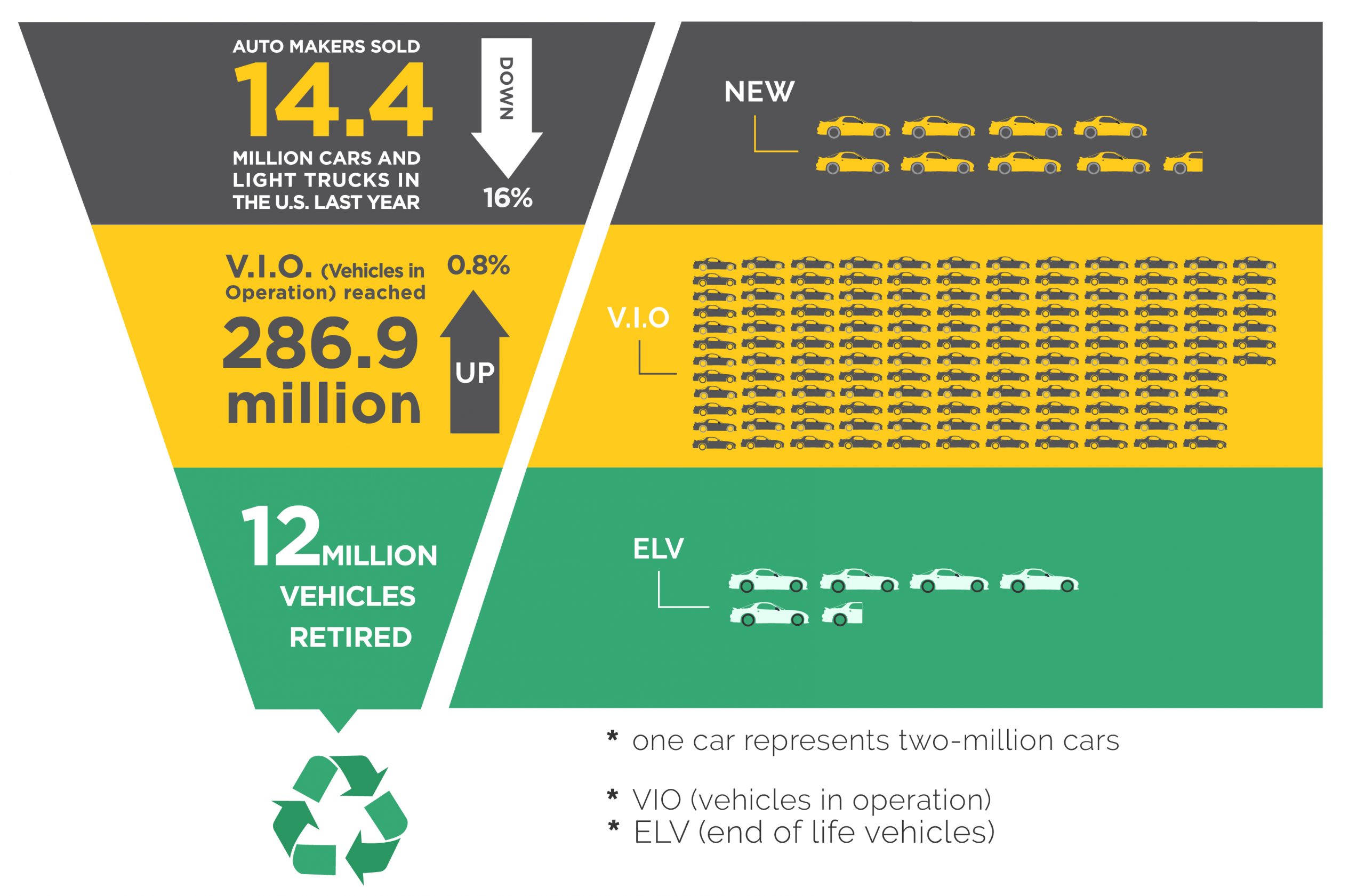

Vehicles In Operation (VIO)

While the scarcity of new cars has been gobbling up much of the recent headlines, registration data for 2020 shows that , Vehicles in operation (VIO) actually rose to over 287 million units. The lower supply was not able to revert the VIO growth trend.

Source: Bureau of Transportation Statistics

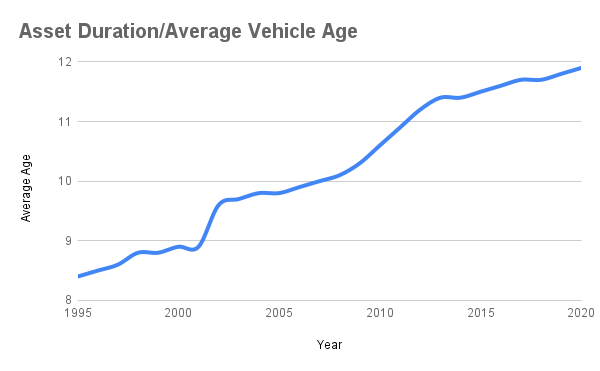

Average Vehicle Age

The Pandemic and supply shortages influenced owners to retain and repair vehicles, contributing to another rise in the Average Age of vehicles. Now at 11.9 years. Due to the coming shortages in new car production, this retention trend is expected to continue for several years. Which should continue the trend of vehicles 16 years and older continuing as the fastest growing segment of VIO. Meaning the supply of older vehicles should remain steady.

2021 Auto Salvage Markets

Pandemic transportation disruptions had a significant effect on Auto Salvage. The reduction in miles driven (above) corresponded to a lower number of accidents in 2020 and a reduction in total loss vehicles available for dismantling. This reduction has led to a product scarcity at a very unfortunate time.

Salvage and Parts Supply

Much of the conversation around parts supply had been on supply chain interruptions for global aftermarket parts. Much of that has recovered but the repair and retention trends have shifted parts demand throughout the channel. While many manufacturing sectors were mothballed for a period of several months, the auto recycling and used parts sector really only paused for a brief period. From the earliest days of the Coronavirus, Auto Repair Facilities, Auto Recyclers and used parts manufacturers were regarded as essential businesses and operated largely without interruption. Many of our recycling partners recorded record traffic in their locations and record sales throughout 2020. In early 2021 supply is having a tough time keeping up with demand. The shortages in scrap and total loss vehicles is increasing competition and rising prices for raw material. Generally auto recycling operations are expecting these challenges of supply to be a question that we will be dealing with for many months to come. Practically as manufacturers our partners will face a new set of challenges to maintain production when supply is inconsistent. The sector hopes that an increase in vacation and business travel is a sign of good things to come.

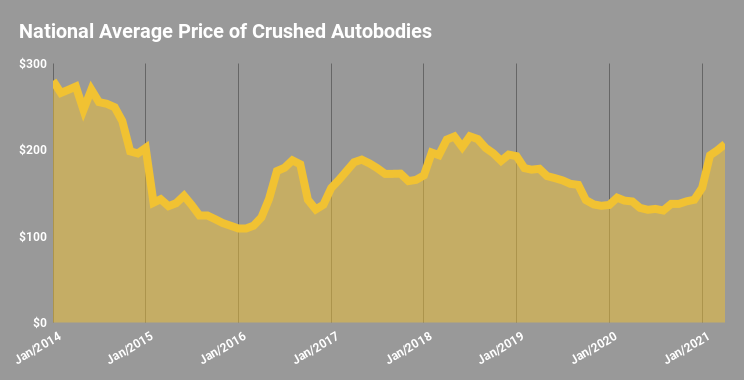

Scrap Markets Rise

As the world economy has been on the rise, demand for ferrous material to support the new wave of production has caused world steel markets to jump. Steel prices in particular have risen for construction, homebuilding and infrastructure. The associated effect on our segment has been predictable.

source: Scrap Metals Marketwatch

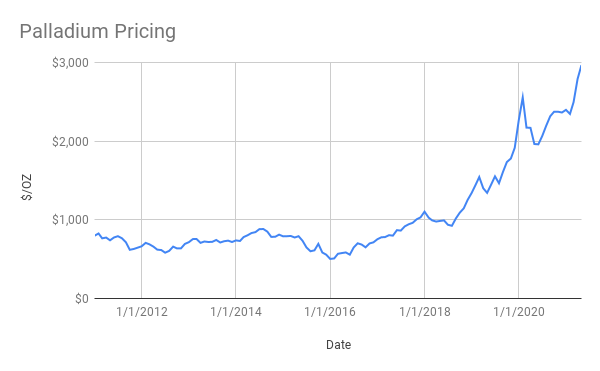

However this skyrocketing demand is seen throughout the commodities market. Metals and mineral markets have blasted into the stratosphere due to increasing demand for chip production or environmental component building. Let’s take a quick look Palladium harvested from Catalytic converters in auto recycling operations.

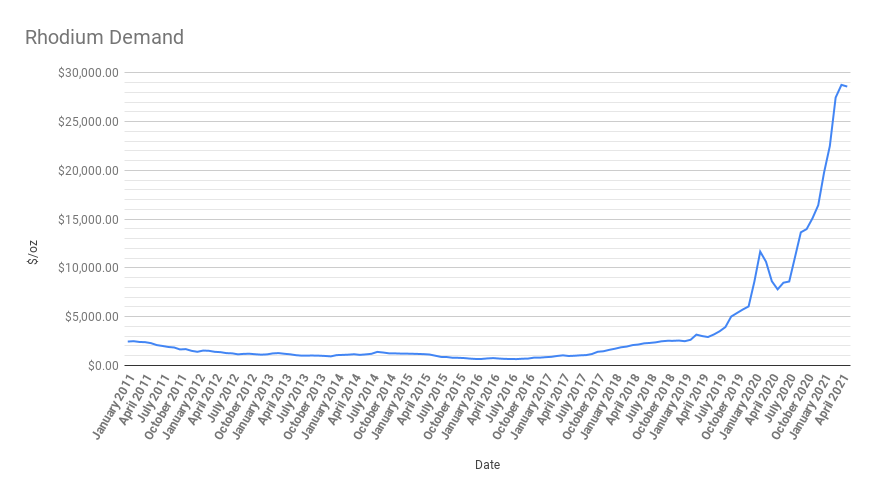

But the star of the current market must be Rhodium. Rhodium is a largely unknown chemically inert transition metal. And it’s primary use is in catalytic converters where it reduces the amount of nitrogen oxides emitted into the atmosphere.

This surge in value has led to a rise in catalytic converter theft throughout the U.S. Our recycling partners are expected to lead the battle against this type of theft by carefully purchasing only though whole car acquisition but the market is littered with opportunists.

Used Vehicle Market

Perhaps the most confounding market has been the near historic demand for used vehicles. As miles driven dropped, the expected result last year was a weakened used car market. However, the inverse demand surprised even the most experienced and most hardened auto market watchers. At wholesale there are several things at working in concert, some new and some familiar.

A sustained demand for travel independence. There was an obvious connection in the early days of the Pandemic as Americans moved away from ride sharing and public transport. This was expected to create a short term bloom in demand but it was larger than anticipated.

Shortages in new car production due to the coronavirus. Supply side interruptions, component delays and manufacturing transformation disrupted the availability of new product.

Works stoppages in production due to single stream problems. Recent headlines regarding microprocessors and chip supply have shut down or mothballed entire plants.

The diminished number of repossessions available for wholesale as credit was extended and stimulus shifted to savings. Cox Auto reported that repossessions were down over 20% from previous year.

Digital Transformation of the Remarketing Industry. The auto auction business will be forever changed by the Pandemic. The conversion to digital purchasing at retail and at wholesale won’t go backwards. As consumers and dealers became more comfortable with the practices of distance purchasing, the supply was sent wider at wholesale. Growth of digital offerings direct selling rather than auction selling moved product in every direction.

What we see now is competition for products unlike anything we have ever seen before. Dealers are desperately competing to maintain a pipeline of veicles to meet current consumer demand. New and Used dealers are feeling product scarcity equally. Many of our dealer partners are concerned that they won’t be able to come near to the product volume needed this summer; these concerns are showing up in pricing data.

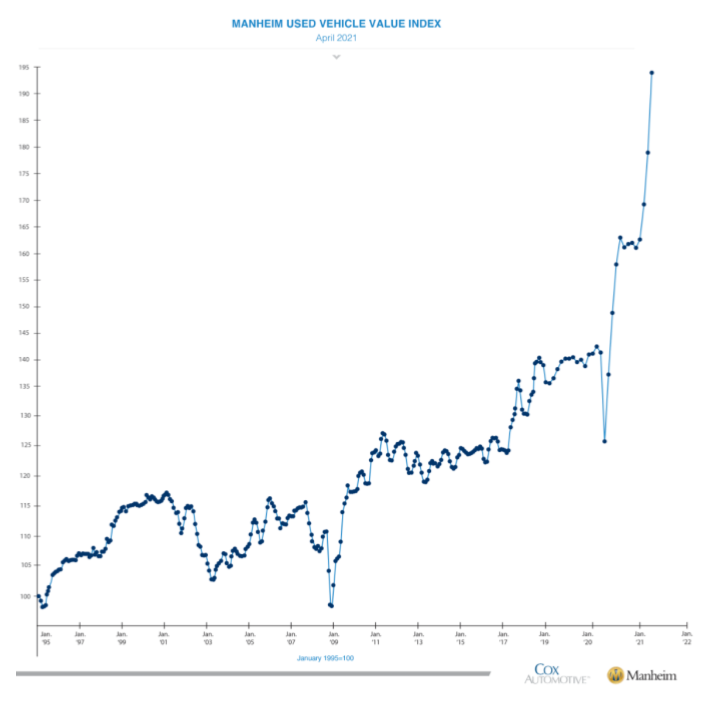

Take a look at the latest Used Vehicle Index data from Manheim.

Clearly the interruptions in supply and the digital transformation is having a big influence on this data. The vehicle mix within the channel is affecting the performance data (selection bias) but it gives a snapshot view of the challenges facing auto dealers in the current market.

Low Value Vehicles and Pandemic Demand

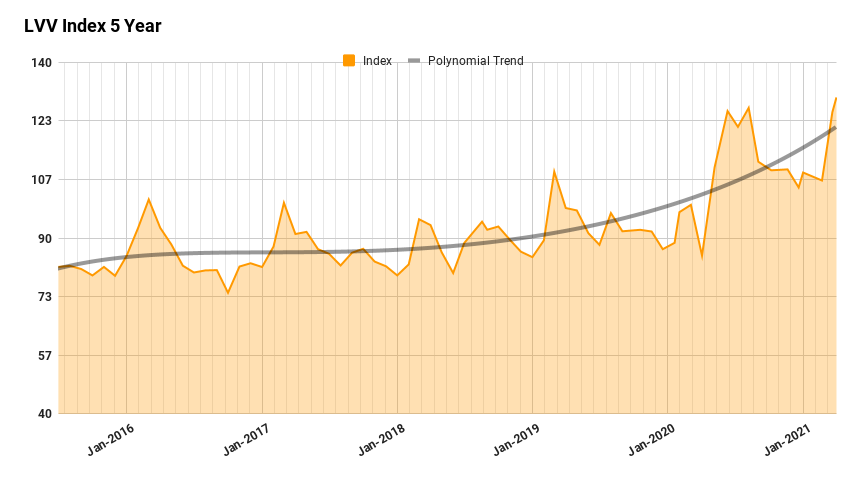

The focus of our Wreckonomics© series, is to examine the sustained and specific appetite for older, high mileage, and negative equity vehicles. Unique to our services, ARS tracks the market on low end vehicles on a daily basis. We pull wholesale market data on high mileage, high year, low ACV units and use a mix of our own data and observed activity to produce an index that helps us work with our clients to make remarketing and channel decisions in real time.

What we are observing is also record highs in demand in our segment. While we observed a surge in July of 2020 the demand has stayed at near or record levels and our index number in April was an all time high.

As with other segments of the transportation sector, these numbers are being pushed by outside influences. While the ELV market remains specific it is at least currently not very finite. Purchasers who fail to fill orders upstream are increasingly flexing their purchasing powers on lower value assets. This influence is expected to last for a few more months at least.

As with other segments of the transportation sector, these numbers are being pushed by outside influences. While the ELV market remains specific it is at least currently not very finite. Purchasers who fail to fill orders upstream are increasingly flexing their purchasing powers on lower value assets. This influence is expected to last for a few more months at least.

Long Term Impacts

It’s difficult to forecast when these supply issues will even out but the horizon for low value vehicles remains very positive for one reason; Frequency. The number of high year, high mileage and high polluting vehicles is now greater than ever and that trend is expected to continue for several years or until the US. Transportation fleet makes a drastic shift to fossil fuel replacement. For the foreseeable future, ARS’s focus and future remain firm. It’s also worth noting the the digital transformation is expected to stay. Which means platforms like our own mBid® are in good position to compete.

mBid remains the most equitable marketplace for ELV and salvage assets. Our technology connects our clients with the the lowest fees between buyer and seller in the entire remarketing industry. During the Pandemic most of our competitors raised buyers fees as demand increased taking a larger share for themselves, our prices remained steady. We’ve always advocated against the increased burden borne buy buyers, and we work in partnership with several of the largest industry groups to continue to deliver alternative sources of volume in a fair exchange.

STAY IN THE CONVERSATION

American automotive markets are facing huge challenges at wholesale and retail. Remarketers, Repossessors, Fleet Operations, Insurance Salvage and Finance verticals are facing uncertainty at near record levels. Success is harder and more elusive than ever. There is no immediate rescue coming, no unified vision about the future. For those of us who compete in related industries; How do we run our businesses? Can ‘we’ as industry leaders forecast our models, budget for recoveries, allocate for staff and navigate competition?

About ARS

Advanced Remarketing Services (ARS) works closely with our clients to identify low value vehicles and end of life vehicles (ELV) units in their asset pool. Our focus on older high-mileage and negative equity units helps to reduce fees and deliver the highest possible returns..

If you have a pool of low value vehicles in your portfolio or if you’re looking at ways to maximize recoveries, please reach out to us at ARS. Send us an email: success@arscars.com

Visit ARS Market & Metals blog:

https://www.arscars.com/category/market-metals/

And subscribe for updates!