After sharp declines in the U.S. scrap steel prices bounce back and stabilize while data comes out on steel and aluminum imports and palladium struggles to hold its record value.

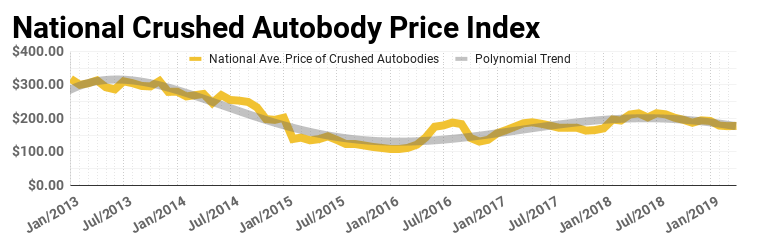

Scrap steel prices remain stable for the second straight month as we get closer to the warmer weather of spring. Since falling over over 8 percentage points in the first few months of 2019, the value of scrap steel has been encouragingly steady. Reports from news sources around the industry have even reported some slight bounce back over the course of the last month.

Month over month the average price of crushed auto bodies increased by a little over 1/2 of a percent. Across the country this equates to a $1 increase in the national average up to just under $178/ton. Comparing the current market to the same month in 2018 shows a 16% decrease in value. This is actually the biggest year over year drop for scrap steel in exactly 3 years. However, compared to three years ago the scrap metal market is much stronger today.

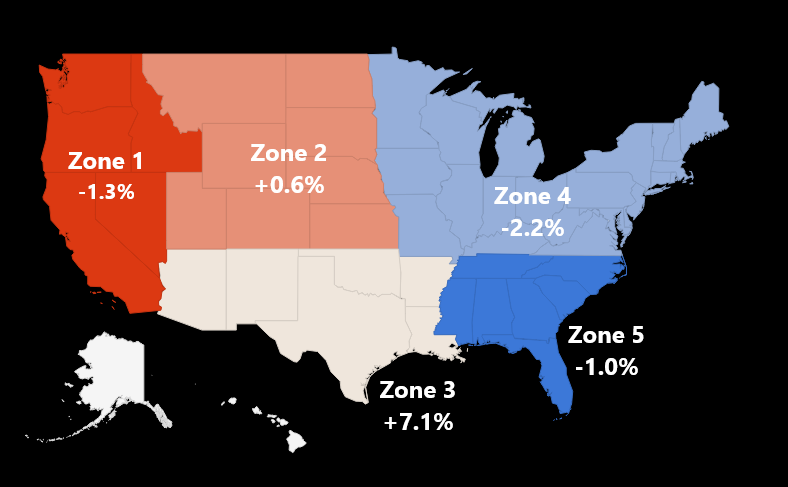

Regionally, there was a bit more variability in scrap metal performance this month. While overall the national average price increased, 3 out of 5 regional zones still suffered market drops (though nothing significant). The largest increase in scrap value was seen in Zone 3 (southwest), which vaulted over 7%. Zone 2 (northwest) was the only other zone to increase in scrap value though it was a less than 1% jump.

Checking in on effects of tariffs on steel and aluminum imports in 2018 as well as looking at the recent performance of palladium, the metal more valuable than gold.

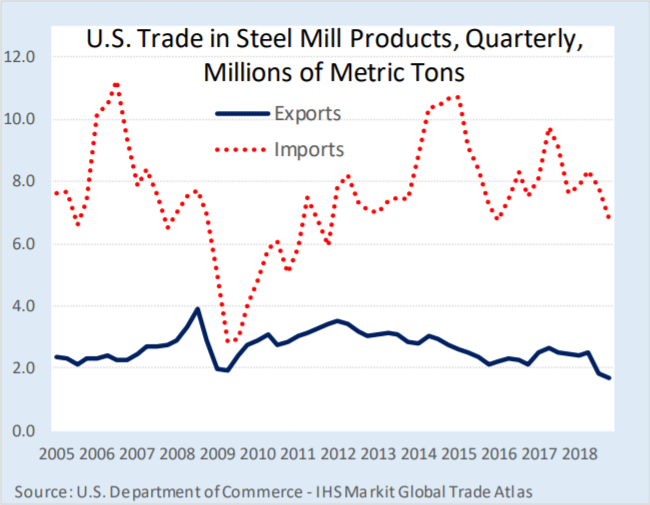

Just over a year ago, steel and aluminum tariffs were enacted under Section 232 on the basis of “national security concerns.” In 2018, the U.S. imported steel and aluminum products totaling $29.5 billion and $17.6 billion respectively. The largest declines in imports occurred in South Korea (-15%), Turkey (-35%) and India (-49%). Steel imports increased in from the EU (+22%), Mexico (+20%) and Canada (+19%). Mexico, Canada and the European Union of course were exempt from tariffs after they were initially enacted. Overall there has been a clear change to import levels for the worlds number one purchaser of steel mill products.

Palladium Pullback

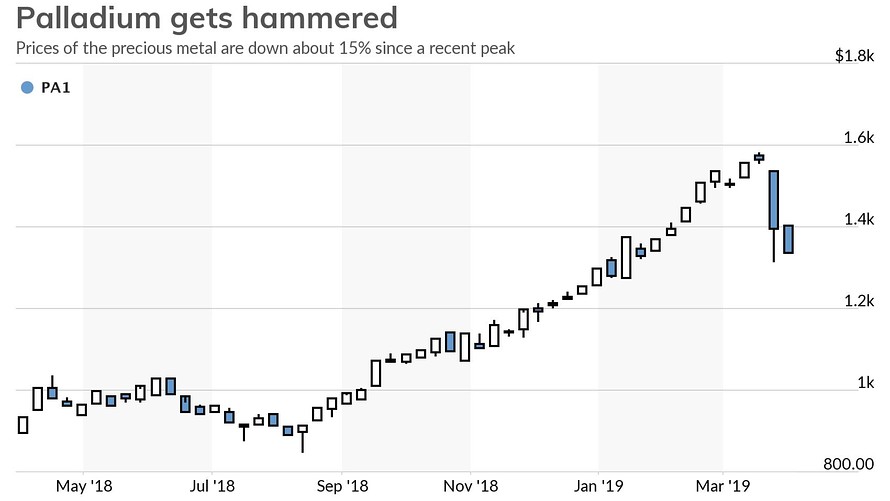

Since its recent peak, palladium (the rare precious metal used in catalytic converters) which eclipsed gold as the most valuable precious metal in the beginning of 2019, has since decreased 13% from its all-time high. The white metal which had been white hot was soaring due to strong demand from the automobile industry is expected to skid further as auto sales falter. Also playing a factor into the price drop is a pivot to the use of platinum by some auto manufacturers due to the price disparity of the metals.

We will continue to review scrap steel prices and other commodities markets on our blog and social pages. Check out our Wreckonomics series as well for updates and company news from industry events!