Palladium Eclipses Gold As Most Valuable Precious Metal

In 2018 palladium was one of the top performing commodities surging past gold in value. Throughout the past year many of the metals found in automobiles like steel or aluminum have struggled in the market due in part to tariffs and a global economic slowdown but one that rose to the top is palladium. In

Scrap Metal Market: December 2018 Steel Prices Going Forward

Steel prices were up going into the last month of the year but are feeling pressures from falling oil prices, lack of exports overseas and slowing auto and housing industries. The December scrap metal report is ultimately a welcomed sight after four consecutive months of declines. While scrap steel prices were up and down in

Tesla Effect: Lithium to Lift Commodities

Lithium to Benefit Aluminum, Copper Today, battery-powered vehicles represent only 2% of the consumer market, with lithium demand for batteries at about 175,000 tons annually. Manufacturers including Tesla, Chevrolet, and Nissan have plans to expand production significantly over the next five years, requiring more lithium, which is concentrated in a handful of locations in Chile,

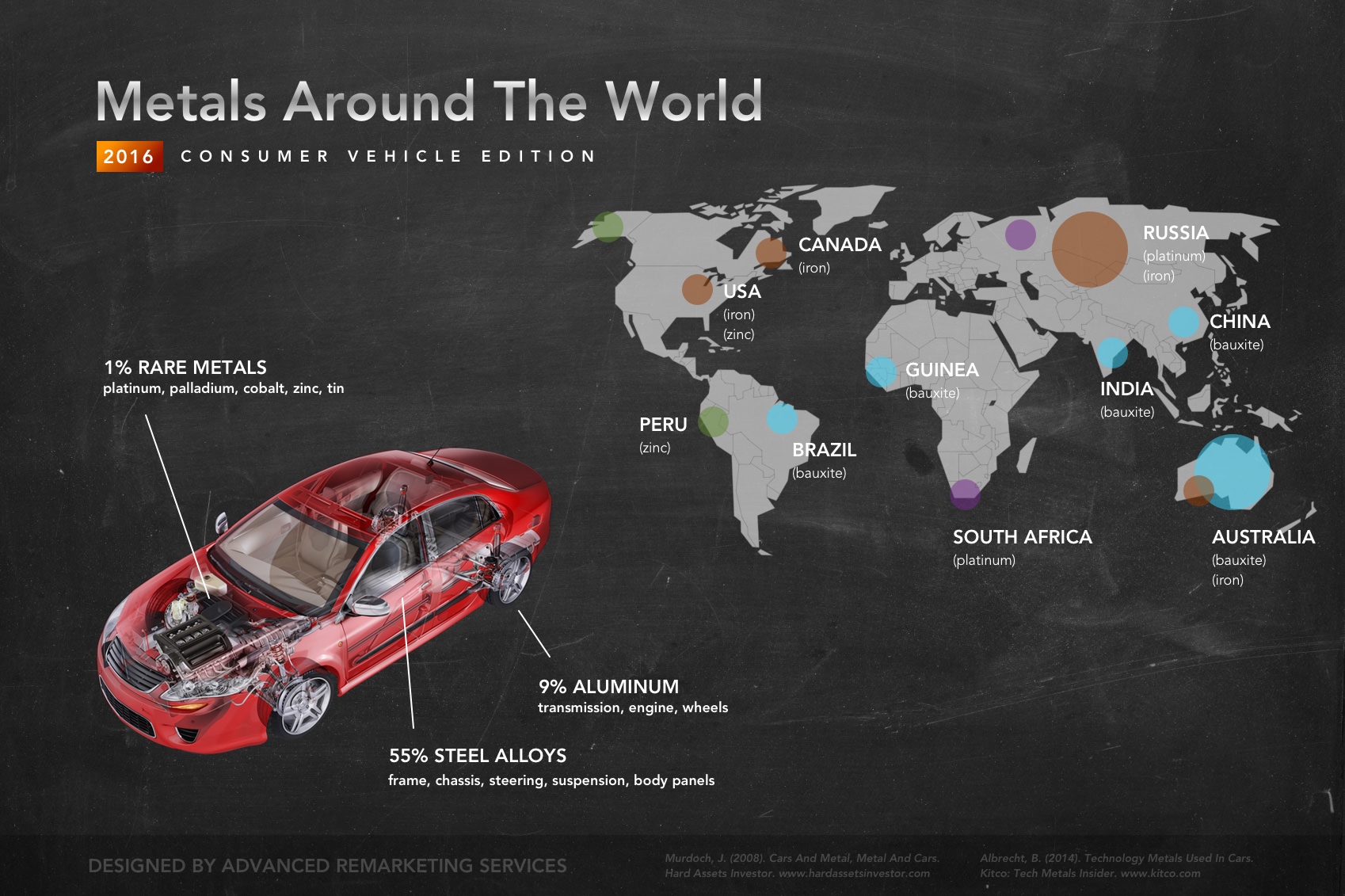

2016 Metals Around The World

2016 Metals Around The World: Consumer Vehicle Edition

Scrap Metal Market: April 2016

Scrap Metal Market Trends Scrap metal prices for crushed autobodies have slightly increased 8.57% over the past month (see March 2016 Scrap Metal Market Watch), but an overall 9.66% decline over the past year. Over the past month, the automotive industry has shown continued signs of devaluation. The Wall Street Journal reported the scrap metal

Aluminum and Copper Plummet

A hybrid of economic forces continues to reduce already depressed prices of metals, including gold, steel, copper, and now aluminum. “China’s stock market crashes again as panicking sellers lose faith” reads today’s headline, underscoring the gravity of weak demand while giving speculators cause to lower oil futures below $50 per barrel.1 Mining production has increased