[avatar user=”zlasky” size=”thumbnail” align=”left” /]

The last post in our Wreckonomics™ series focused on the challenges facing the scrap market including a peek into the metals markets and values for crushed auto bodies. Today, we take a look at the rapidly changing used vehicle wholesale landscape.

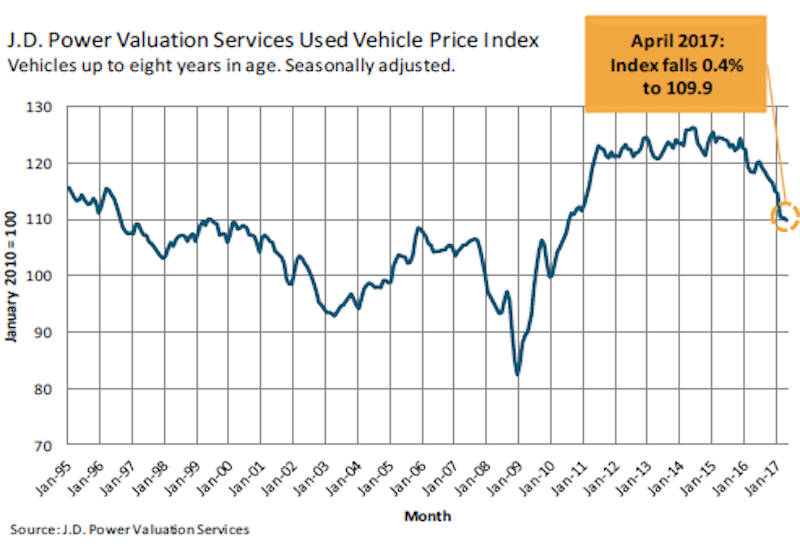

The used marketplace is trending downward to levels not seen since the last economic depression.

As you can see above, there has been 10 consecutive months of decline. In April, prices dropped 1.5% from the previous month. Overall the index is down over 7% from this same time a year ago and over of 13% from its peak in 2014. The index is currently at its lowest point since September 2010, when prices bottomed out due to the cash-for-clunkers program.

To explain and understand this reduction in value, we’re tracking 3 factors:

- Struggling New Car Sales

- Record Supply of Nearly New Units

- Weakened Financial Markets

New Car Markets

The used car market isn’t the only vehicle segment feeling the pressure. The new car retail segment is where we see some of the most conspicuous changes. The market might not be large enough to absorb the volume of vehicles presented for sale. Despite sales incentives averaging almost $4,000, new vehicles are sitting on dealer lots for an average of over 70 days; the highest level since 2009. Additionally, overall Dealer inventory of new vehicles has escalated to levels that haven’t been seen since 2004.

Despite the traffic jam on dealer lots automakers are not likely to cut back on production of new vehicles. Manufacturers don’t want to take the risk and lose any market share. It makes for a very uncertain horizon.

Record Supply of ‘Nearly New’ Units

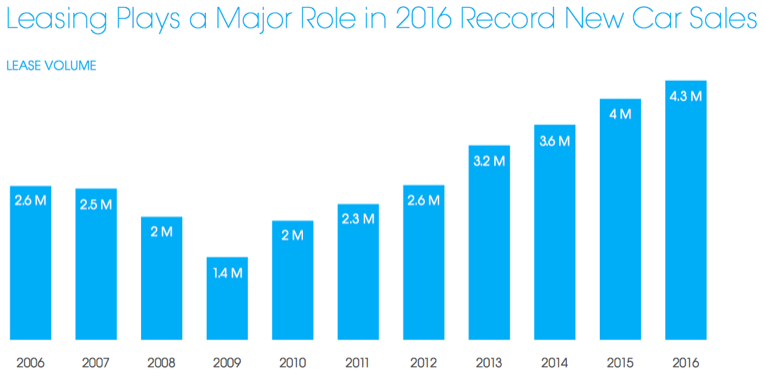

As Americans moved more and more to leasing over purchasing another hugely disruptive force was set against future value. From 2012 to 2016 leasing has risen 91% to 4.3 million new leases.

These vehicles are now coming off lease and flooding the wholesale marketplace. An estimated 3.1 million units came off lease in 2016 and it is expected to be more than 4 million in 2018. While leasing rates started to level off at the end of 2016 and into 2017 we still have to deal with this volume of lightly used, low mileage used vehicles hitting the market. This excess volume is putting downward pressure on the wholesale car market, particularly the late model segment.

“Weaker new-vehicle demand so far this year could spell trouble for the industry moving forward. That’s because the market might not prove to be large enough to absorb roughly 3.5 million off-lease vehicles set to return to dealership lots this year.” -John Murphy, Analyst at Bank of America Merrill Lynch, Off-lease vehicles could send U.S. sales tumbling, analyst warns, Automotive News.

Based on the current pace of new vehicle production (17.1 million units in 2017) Murphy believes that we are going to fall short of the amount needed to absorb the off lease vehicles and “prevent a significant decline in used-vehicle pricing.”

Weakening Financial Markets

After the credit uncertainty of 2009, lenders were eager to finance the vehicle boom of the last seven years. We saw record loans in several segments including a booming market for subprime loans. However, in 2017, fewer subprime borrowers are paying off their loans early. Debt is now ballooning and lenders are tightening their underwriting standards. While auto loans and leases outstanding still rose in the 1st quarter this year it was by less than half of the average quarterly increase across the last five years.

Another worrisome aspect of auto debt is that lenders have been extending repayment period to vehicle owners at an aggressive pace. In the 1st quarter of 2017, 33.9% of new vehicle buyers got loans of at least 72 months, a 32.6% increase from a year earlier. These longer term loans on rapidly depreciating assets combined with rising delinquencies and interest rate hikes from the Federal Reserve will squeeze automakers profit margins. Potentially this could limit dealers abilities to offer deep discounts to customers.

OVERALL OUTLOOK

Most economists predict that the current conditions are going to continue over the next couple of years and many people are hedging bets about recovery. As off lease volumes continue their growth in wholesale and used markets, Morgan Stanley forecasts that we could see an additional 20% drop from current levels. Their most aggressive forecast even predicts prices falling as much as 50%.

In April, General Motor’s Chief Financial Officer stated that the prices of used cars in their leasing portfolio will decline 7% this year. These concerns are in line with Ford Motor Co. who cut its lending units profit forecast by $300 million last year.

So what does all this mean?

- It means that the largest sector in American manufacturing is heading for a tough stretch, which is bad for the automotive industry but also bad for the economy overall (automakers are responsible for 3% of America’s GDP).

- For those of us in wholesale remarketing, recoveries are going to miss estimates, and challenge organizations at many levels.

- Historical inefficiencies of channels are going to stand out and require attention.

- Organizations are going to have to get smarter to offset value losses

Low Value Vehicles In A Deteriorating Market

There is some good news. None of this means that demand will disappear. The market for disposable transportation is an important part of our American experience, it keeps us working, moving and hopefully growing. However, opportunity for success is going to be harder to come by than any point in the last 20 years.

At ARS we understand that every client has a unique portfolio. Using up to the minute data and a responsive approach we are able to place each and every vehicle into the place to succeed. In this NEW NORMAL marketplace, your remarketing returns cannot be looked at in the same way. We believe that in order to maximize your returns it takes a segmented Full Channel Remarketing™ strategy. Advanced Remarketing Services can help. We’ll work with you to review your entire portfolio and develop strategies to navigate the shifting opportunities. Give us a call, drop us an email or visit us at www.arscars.com

If you have a pool of low value vehicles in your portfolio or if you’re looking at ways to maximize recoveries, Reach out to us at ARS. Send us an email; success@arscars.com

STAY IN THE CONVERSATION

Visit ARS Market & Metals blog:

https://www.arscars.com/category/market-metals/

And subscribe for updates.